Last Updated on December 24, 2025 by Joy Kyalo

UK company formation for just £0.99 and get your UK virtual office address for only £0.88 – available for both UK and non-UK residents!

A Value Added Tax registration number is a unique code issued by HM Revenue & Customs (HMRC) to businesses or taxable persons that have registered for VAT. Businesses registered with VAT can charge VAT to their customers on top of their products prices. VAT is a sales tax that businesses collect from their customers and pay back to the government. The standard VAT rate in the UK is 20%.

Is a tax ID the same as a VAT number in the UK?

Tax ID and VAT numbers are not the same. UTR (Unique Taxpayer Reference) number is the tax ID issued in the UK to registered businesses and individuals and is used for filing Tax returns. While VAT numbers are only issued to businesses registered for VAT. Businesses can use the VAT number to charge tax (VAT) to their customers on top of product / service prices. If the business has paid VAT to any of its VAT registered suppliers or vendors for business purchases then they can claim this from HMRC as well.

Do I need a VAT number in the UK?

Whether you need a VAT number depends on your business’s taxable turnover. If your business’ VAT taxable turnover for the last 12 months is more than £90,000 (the VAT threshold), you are legally required to register for VAT.

Additionally, you will need a VAT number if you expect your turnover to go over £90,000 in the next 30 days.

You will also need a VAT number if you only sell goods or services that are exempt from VAT but you buy goods for more than £90,000 from EU VAT-registered suppliers to use in your business.

You can also apply for a VAT number even if your turnover is less than £90,000 through voluntary registration.

How to obtain a VAT number in the UK?

We offer VAT registration services where we will do an online application for you after you provide all the necessary documents for only £34.99.

We will handle all communications with HMRC on your behalf and update you on the status of your application.

We also do monthly and quarterly VAT returns to ensure VAT compliance. This service can save you time and effort in managing your VAT obligations.

Before you register for VAT, make sure you have;

- your tax reference number

- your business contact details

- your business’s annual turnover

- national insurance number

- information on the nature of your business

- bank account details

- records of companies you’ve previously owned (over the previous two years)

Once registered, you’ll receive a 9-digit VAT number to include in all invoices. You will also get information about when to submit your first VAT return and payment and a confirmation of your effective date of registration.

Where can I find my UK VAT registration number?

UK VAT registration number can be found on your VAT certificate. It is always sent by HMRC to you after completing the application process. You can also find it in the correspondence from HMRC regarding your VAT number.

Additionally, a VAT number can be searched on the HMRC website. You will be able to find your VAT details and number.

When will I use my VAT number in the UK?

You will use your VAT number when submitting VAT returns and dealing with various transactions. Here are some common scenarios where you’ll need to use your VAT number:

- When issuing invoices or bills to your customers, including your VAT number which will make it easier for them to identify your business as VAT-registered.

- Monthly submission of VAT returns at the HMRC needs the use of VAT number.

- Selling goods or services to other VAT-registered businesses, your VAT number may be requested for record keeping.

- When buying goods and services from VAT-registered businesses you will need their VAT number for your accounting purposes. This ensures accurate reporting and compliance.

- If your business exceeds the specified thresholds for intra-EU trade, you’ll need to provide your VAT number when submitting Intrastat declarations.

- When reclaiming any VAT paid on goods and services bought for business use.

What does a VAT number look like?

A UK VAT number comprises nine digits, with the prefix GB followed by the numbers. The first two letters of “GB” stand for Great Britain and the remaining seven digits are unique to every registered business.

For businesses in the European Union, their VAT numbers vary. The VAT starts with the country code followed by seven digits. These VAT numbers will be used for all transactions within the UK and EU.

How to find a company VAT number?

Companies often place their VAT number in their invoices, contracts, and government documents. Also, when a company registers for a VAT number, their details are always public making it easier to access a company’s VAT number.

How do I check if a VAT number is valid?

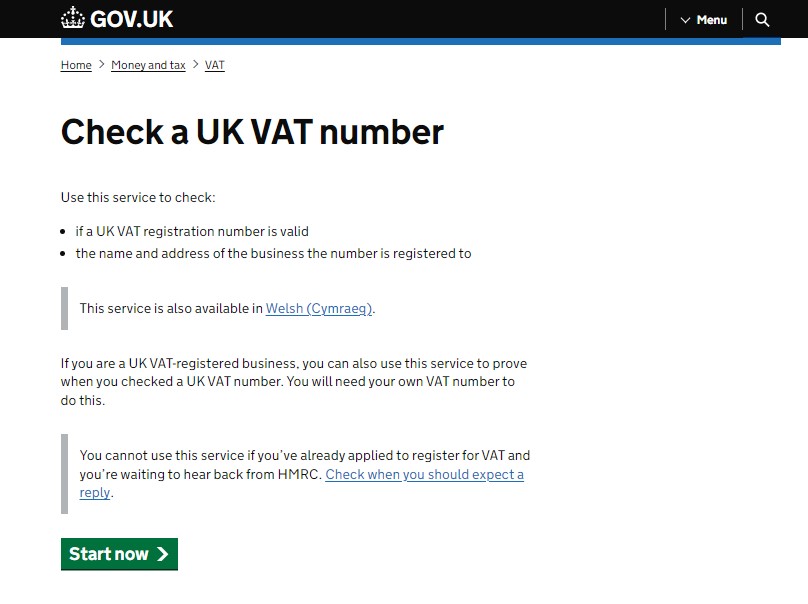

You can use the HMRC website to verify a VAT number in the UK or the European Union (EU). HMRC also provides an online service to check the validity of UK VAT numbers and to identify the name and address of the registered business.

To verify if a VAT number is valid, you can use the VAT Information Exchange System (VIES), owned by the European Commission. It retrieves information from national VAT databases.

To check the validity of a VAT number Click Here.

How to remain VAT compliant in the UK?

Businesses with VAT taxable turnover exceeding £90000 must register for VAT.

Keep VAT records and file VAT returns regularly and on time during your accounting period to avoid fines, interest charges, and even criminal charges for intentional VAT fraud.

By charging the correct VAT when selling goods and services. The VAT rate is usually 20% on each transaction.

Always keep an accurate record of your sales, purchases, and transactions.

Before you register for a VAT number, check your eligibility and understand the requirements and regulations surrounding it. We offer simple and quick VAT registration services and even do a VAT return monthly and quarterly. If you have any questions about VAT, feel free to reach out to us.

Read Also:

- What are the Advantages and Disadvantages of being VAT Registered?

- Understanding the Importance of a Tax Identification Number in the UK

- Can i Change my Limited Company Name: The Ultimate Guide

- What is Postal Fraud and How can BusinAssist Help me From Being a Target?

- What Are the Disadvantages of a Dormant Company?

- Everything You Need to Know About Companies House Default Address

- How to Find a Company’s VAT Registration Number in the UK: A Step-by-Step Guide

- What is the VAT threshold? – A Comprehensive Guide

- The Hidden Costs of Being VAT Registered: Is It Killing Your Business?

The BusinAssist Editorial Team has 15+ years of experience writing about small business and company formation in the UK, Canada, and the USA. We simplify complex processes and provide practical insights to help entrepreneurs succeed. Business Assist with BusinAssist – your partner for business success.