Last Updated on October 13, 2025 by Joy Kyalo

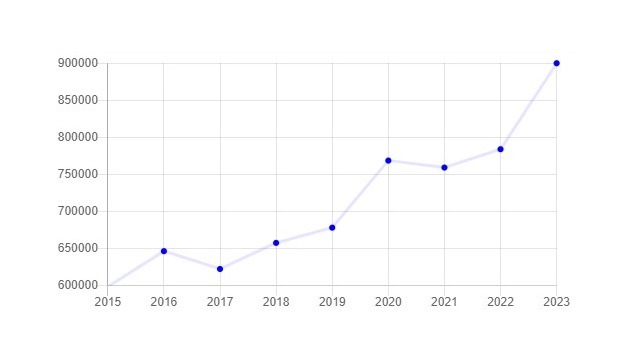

The United Kingdom has seen a rise in the number of businesses being established. In 2023, UK company formations reached an all-time high. According to Companies House, 900,006 companies were incorporated in a single calendar year.

The surge in new businesses reflects confidence and an entrepreneurial environment within the UK business community.

While there were adjustments to fees on May 1st, 2024, UK company formation remains to be the most affordable process globally. International entrepreneurs who want to join the fast-growing list of companies, can set up a UK limited company and tap into the growing market.

As much as there was a rise in company formation, there was also a surge in company dissolutions. According to Companies House, the number of company insolvencies in Q3 2023 was 2% lower than in Q2 2023, but 10% higher than in Q3 2022. The number of compulsory liquidations and administrations increased to levels last seen before the coronavirus (COVID-19) pandemic.

When starting a company, entrepreneurs should understand the market trends and legal regulations to help them stay afloat and keep up with the changes that come along in the market.

Ready to start your own UK limited company? In this article, we will walk you through how you can form a company in the UK regardless of your location and how you can keep your business afloat in this ever-changing market environment.

Understanding business structures

A business structure is a legal corporate structure that influences the day-to-day operations of a business.

The UK has several legal structures that you can choose from for your business. The structure you choose will have an impact on your company such as taxation, personal liability, and workforce needed to perform administrative work. The structures are:

Sole trader: An individual operates a business without any legal structure and is personally liable for business obligations, and tax returns which must be filed with HM Customs & Revenue. However, there’s no need to pay corporation tax on profits.

Partnership: A partnership that involves two or more individuals working together with a common profit objective. It can be formed under a partnership deed or even without a written agreement. Partnerships are less common due to the rise of company incorporations. However, they still offer flexibility.

Limited Liability Partnership (LLP): This is a hybrid structure that combines a traditional partnership and a limited company. It has a separate legal entity that impacts the liability of the partners meaning, LLP partners/ members have a limited liability protection for debts and obligations of the business.

Limited Company: A business structure that is separate from its owners or directors meaning the company itself is responsible for its liabilities. This provides limited liability protection to directors, owners, and shareholders.

Selecting a business name

Businesses have previously failed due to a name that just didn’t work for their business. A name differentiates your business from those of your competitors.

In the UK, there are rules and regulations when it comes to choosing a name for your business. They include:

- Your chosen name must be unique and not the same as another registered company’s name. Avoid names that are “too like” existing names or trademarks.

- Your company name cannot be offensive or sensitive. Avoid using sensitive words or expressions without permission. For example, using “Accredited” requires permission from the Department for Business and Trade (DBT).

- The names of private limited companies in the UK must end with either “Limited” or “Ltd.” Welsh companies can use “Cyfyngedig” or “Cyf” instead if registered in Wales. You don’t have to use limited in your company name if articles of your association say your company:

- Cannot pay its shareholders through dividends

- Promotes or regulates commerce, education, science, art, and religion

- Requires each shareholder to contribute to company assets within a year of them stopping being a shareholder.

- You can trade using a different business name than your registered name. Business names must not include terms like “limited,” “Ltd,” or “LLP.”

If you choose a name that does not meet these requirements, you will not be able to use it. It is important to check if the name you have chosen for your company is available at the Companies House name availability checker.

Appointment of directors and shareholders

When appointing directors and shareholders for your UK company, you should familiarise yourself with their responsibilities. The director is responsible for company operations, submitting accurate finance records, and complying with laws whilst shareholders are the owners of the company.

Your company must at least have one human director. Other directors and shareholders can be a corporate body as well. Directors do not need to be UK residents.

To qualify to be a director, one has to be at least 16 years old, not have undischarged bankruptcy, and not have been disqualified as a company director.

Shareholders own the company and vote on company matters. A company limited by shares must have at least one shareholder. You’ll own 100% of the company if you’re the only shareholder. There’s no maximum limit on the number of shareholders a company must have.

Shareholders’ and director’s details are recorded publicly in the Companies House’s register.

Register your business

Registering your company as a non UK resident can be nerve-wracking. You ought to understand the legal requirements when incorporating a UK limited company. You can use a company formation agent like BusinAssist who will walk you through the whole process.

It is important to understand that you will require a UK address to register your business and the director will require a service address. But not to worry, you can also use UK Virtual Office Address as your company’s registered office address. It can also be used as a correspondence address for Directors of the company.

Company formation agents like BusinAssit will help you to set up and register your new company with Companies House and submit all the required documents.

Companies House may take 1 to 2 working days to process the application. Once the process is complete, you will receive a Certificate of Incorporation. The certificate is evidence that your company is registered under the Companies Act 2006, and has complied with all requirements under the act for registration. The certificate will state: the name and registered number of the company. the date of its incorporation.

Tax registration

Register for tax purposes with HMRC. Non-resident entities may have additional tax regulations and rates compared to UK-based businesses.

Companies conducting trading activities in the UK are subject to UK Corporation Tax on their profits. If they are receiving certain types of income from UK sources, such as dividends or royalties, they may also be subject to withholding tax.

Additionally, companies engaged in taxable activities in the UK may be required to register for Value Added Tax (VAT) if their turnover exceeds the VAT registration threshold which is currently at £85,000.

You should familiarise yourself with all tax regulations in the UK to comply with them.

Open a business bank account

Having a UK bank account is essential for business transactions and financial management. A business bank account keeps personal and business finances separate making it easier to track finances and taxes.

Digital bank providers offer a range of services such as merchant services, international money transfers, and overdraft facilities. Some online banks do not require a UK address and provide multi-currency accounts, allowing for global business transactions.

How BusinAssist can help your business in the UK

BusinAssist can help both UK and non-UK entrepreneurs navigate the UK market with our international company formation services. With our simple and easy online process, you will be able to fill in your details as we do all the paperwork and submit them to Companies House.

Once you start trading, we can help you set up your business bank account. We have partnerships with banks such as Tide and Cashplus where you can get up to £70 cash back once you open a business bank account. With our banking partners in the UK, you can seamlessly open a UK business bank account online without a physical meeting.

We also offer VAT registration service for businesses that meet the £85,000 threshold. You must register for VAT if your company’s total VAT taxable turnover will be more than £85,000 in the next 30-day period. You can also register for VAT voluntarily even if your business has not met the threshold.

Tapping into the UK market is a good way to expand your business globally. If you are in need of company formation services, contact us at info@businassist.com.

Read Also:

- What is a VAT registration number? – A complete guide

- What is a Certificate of Incorporation and How Can one be Obtained? 2024 Guide

- Details of Companies House Reforms Planned in the UK in 2024

- How to Form a UK Company as a Non-UK Resident? – A Complete Guide

- Everything You Need to Know About Companies House Default Address

- Why Use A Company Formation Agent to Set Up a Company

- The Hidden Costs of Being VAT Registered: Is It Killing Your Business?

- Best Company Formation Agents in the UK 2025: Choose BusinAssist for a Smooth Start

Joy is a content writer at BusinAssist with 6+ years of experience in content marketing and social media strategy. She specialises in company formation and virtual operations, guiding entrepreneurs through global markets with clarity, drawing on her marketing and PR background. Business Assist with BusinAssist – your business success partner.