Last Updated on January 1, 2026 by Joy Kyalo

Addresses can raise many questions when starting a UK business. Companies can maintain multiple addresses in the UK, including a UK registered office address, a service address, a trading address and a Single Alternative Inspection Location (SAIL) address.

A registered address is a legal requirement that companies registered in the UK must maintain as per the Companies Act 2006. A registered business may choose to register its business in one location and operate its business in another location. A business can also choose to operate elsewhere other than the registered address known as a trading address. This is optional; not every business needs to have it.

Trading address vs registered address, what is the difference? This article will explore everything you need to know about these addresses, from their descriptions to why your business needs to maintain them.

Key Takeaways

- UK businesses can have various addresses, but a registered address is legally mandatory for limited companies for official communications.

- A trading address is where daily business operations occur; it’s optional but crucial for marketing and tax filings.

- The registered address is public via Companies House, while the trading address can remain private.

What is a trading address?

While it is not a legal requirement to maintain a trading address, most businesses that operate remotely and are home-based do have a trading address. It is the address where the company conducts its business activities from the company’s registered location.

For instance, your company may be registered in London, but your business operates in Scotland; Scotland will be your company’s trading address.

In simpler terms, a trading address is where the company runs its everyday operations from. Also known as a business address, it can be used for marketing, client communication, websites, business cards, bank correspondence and supplier interaction. A trading address is also needed for Value Added Tax (VAT) registration and Self-Assessment tax return.

You may be wondering if a trading address is made available in the Companies House public register, and the answer is no.

Why do businesses need a trading address?

- For business operations. Where the business conducts its daily operations.

- Business correspondence, such as bank notices, suppliers’ invoices, clients’ mail, and marketing sources.

- To enhance professional image and credibility, especially if the business is remote or home-based.

- For registration of VAT and Self-Assessment tax returns

- To separate official and non-official correspondence to improve efficiency

What is a registered address?

A registered address is a legal requirement under the Companies Act 2006. According to the act, a registered address should not be a P.O. Box but an address physically located on a street.

A registered address is used for UK limited company registration. When registering a company, you must choose a UK registered address physically located in the jurisdiction where you are incorporating it.

For instance, if you are living in Scotland but want your company registered in London, you must choose a registered office address in London.

Companies must maintain a UK registered office address since Companies House, HM Revenue & Customs (HMRC) and other government agencies send correspondence and legal notices there. A registered address must be accessible for correspondence and confirm delivery of formal notices.

A residential address can be used as a registered office address; however, to maintain the privacy of your home, you can use a virtual office as a registered address.

Why do you need a registered address?

Legal requirement: A registered address is a legal requirement. Limited companies must maintain an accurate and up-to-date registered address at all times. In case of change, Companies House should be notified within 14 days.

Receive correspondence: A UK registered office address must be accessible for companies to receive official correspondence and legal notices from government agencies.

Professional image: If you are using a registered office service provider, then your business address will be located in prestigious locations, which enhances the professional image and credibility of your business. if you are working from home or remotely, a virtual office in UK will be best to enhance confidence with your customers and partners.

Privacy: A registered address is made available in the public register, meaning that by using a London virtual office, you get to protect your residential address.

Flexibility: By maintaining a registered address, you get the flexibility to operate anywhere you want. A registered address doesn’t necessarily mean that you have to physically work in that jurisdiction. You can maintain a physical presence where your company is registered and operates in another jurisdiction.

Trading address vs registered address: What are the differences?

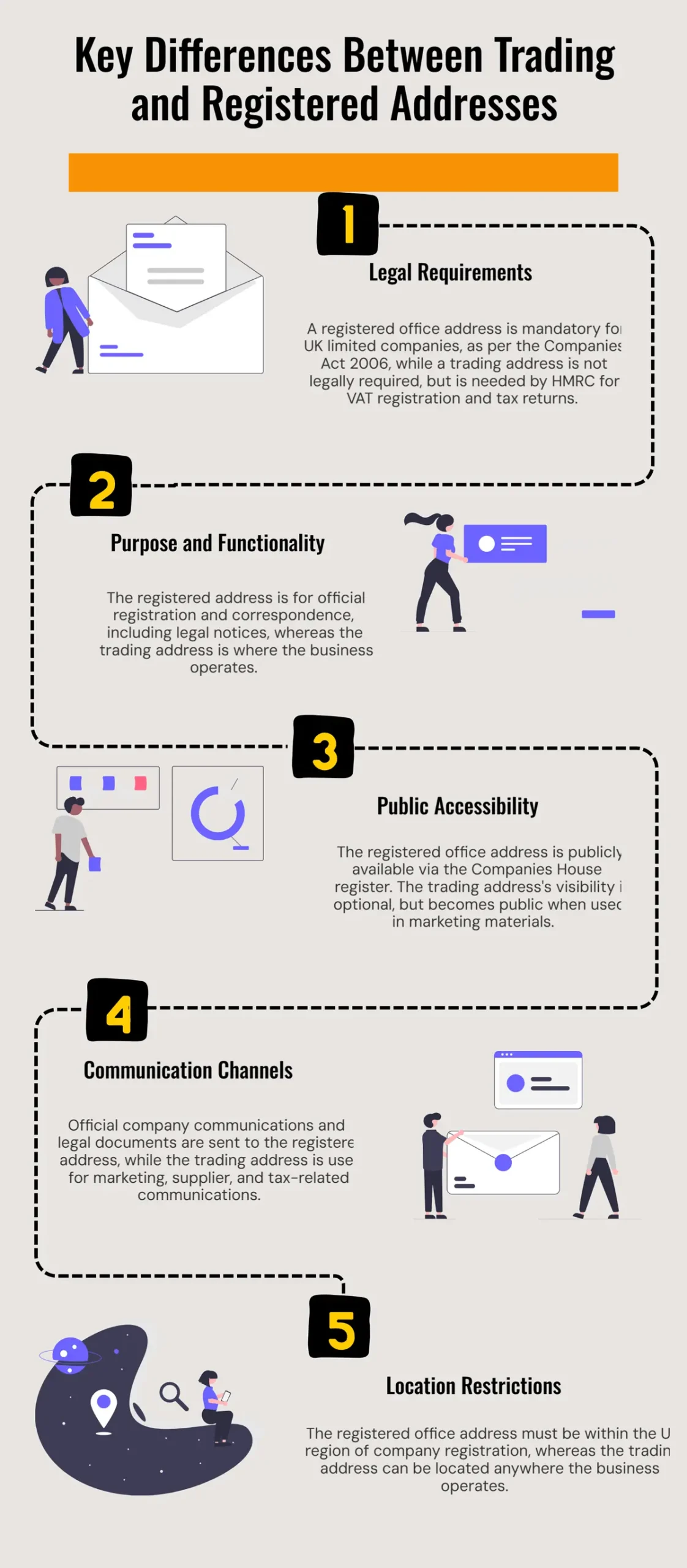

Legal requirement: A registered office address is a legal requirement for every registered limited company in the UK, according to the Companies Act 2006, whereas a trading address is not a legal requirement. HMRC will require the trading address for VAT registration and Self-Assessment tax returns.

Purpose: The registered address is used to register a UK limited company and receive official correspondence and legal notices, whereas a trading address is where business operations are conducted.

Public visibility: The registered office address is made available to the public at the Companies House register. For the trading address, you can choose to either make it public or not; however, when using it on your marketing materials and website, it is made public.

Communication: Companies receive official documents at their registered address, whereas a trading address is used for marketing and supplier communications. It is also used for tax correspondence, such as HMRC.

Location requirement: A registered office address must be in the same location where the company has been registered in the UK, whereas a trading address can be located anywhere the business is operating.

Conclusion:

In conclusion, trading address vs registered address the difference is that one is a legal requirement, unlike the other. It is okay for a company to maintain both addresses, but the registered address has to be accurate and up-to-date. In the case a company changes its registered address, Companies House must be notified within 14 days.

Whether you need a registered address or a trading address, BusinAssist has got you covered. We offer UK virtual office services, which can legally be used as a UK registered office address. Our services offer you the flexibility of registering and operating a company in the UK, no matter where you are located. The virtual office service comes with mail handling, UK virtual number services, call answering services, and other additional services to help your business in smoothly.

For more information, contact us at info@businassist.com.

FAQs

Q: Is the trading address the same as the registered address?

Ans: A trading address is not the same as the registered address. A trading address is where the business conducts its daily operations, whereas a registered address is where the company is registered. A registered address is a legal requirement for every company registered in the UK.

Q: How to change the trading address on Companies House?

Ans: While the trading address is not made available on the public register, you can change it on Companies House by updating your registered address. To change it, you will need to update the company information by submitting form AD01. You can submit it online or by post.

To change it online, you will need to

- Find the company information page.

- Find your company.

- Click on the ‘file for this company’ tab and follow the instructions.

- Enter your new building name or number and postcode. You can find the address or enter it manually.

- Submit your changes.

By post:

- You will have to download form AD01

- Change the registered office address

- Fill out and send it to Companies House

Q: Is the trading address public?

Ans: A trading address is public but not made publicly available on the Companies House register. The trading address can be used on your company website, marketing materials and non-official correspondence.

Q: How to find the company’s registered address?

Ans: You can find a company’s registered address on the Companies House register by searching for it online. You can also find a company’s registered address by searching for it online through a search engine directory.

Q: How to change a registered address on Companies House?

Ans: To change a registered office address online, you will need to

- Find the company information page.

- Find your company.

- Click on the ‘file for this company’ tab and follow the instructions.

- Enter your new building name or number and postcode. You can find the address or enter it manually.

- Submit your changes.

By post:

- You will have to download form AD01

- Change the registered office address

- Fill out and send it to Companies House

Q: Do sole traders need a registered address?

Ans: Sole traders do not need a registered office address since they do not register their business formally with Companies House. A registered address is only a legal requirement for companies registered in the UK.

Q: Can two companies have the same registered address?

Ans: Yes, two companies can be registered under the same registered address. Companies House does not have any limitations on the number of companies that can be registered under the same registered address.

Read Also:

- How to Change a Company Registered Address in the UK: Everything You Need to Know

- Registered Office Address in London, UK: A Guide for Your Business Needs

- Updates: Changes in Companies House Requirements for a Registered Office Address

- Can a Virtual Office Address Be Used as a Registered Office Address?

- What Is a Registered Office Address? Key Facts Every Entrepreneur Should Know

- New Identity Verification Rules from Companies House: A Guide for All Directors & PSCs

- Someone Has Registered a Company at My Address in the UK – Understanding Your Rights

- Can HMRC Access Your Bank Account? What Every Taxpayer Should Know

- The Best Registered Office Address Providers in the UK: How to Choose the Right One for Your Business

Joy is a content writer at BusinAssist with 6+ years of experience in content marketing and social media strategy. She specialises in company formation and virtual operations, guiding entrepreneurs through global markets with clarity, drawing on her marketing and PR background. Business Assist with BusinAssist – your business success partner.