Last Updated on December 17, 2025 by Joy Kyalo

Her Majesty’s Revenue and Customs (HMRC) has the responsibility to oversee all taxes in the United Kingdom (UK). They are in charge of imposing penalties and taking necessary actions when businesses do not comply with tax regulations, as outlined in their HMRC errors and mistakes guidance.

When filing taxes, one may make errors which may result in penalties and interest on unpaid taxes if the mistake is not corrected on time. But what are considered HMRC errors and mistakes?

In this guide, we will highlight common HMRC mistakes, the consequences of the mistakes, and how to avoid those errors.

What are my rights and responsibilities to HMRC?

Understanding your rights and responsibilities to HMRC is essential to ensure compliance with tax regulations. Our HMRC errors and mistakes guidance will help you correct any inaccuracies and outline the steps needed to avoid penalties. Below are some of your key rights and responsibilities to HMRC:

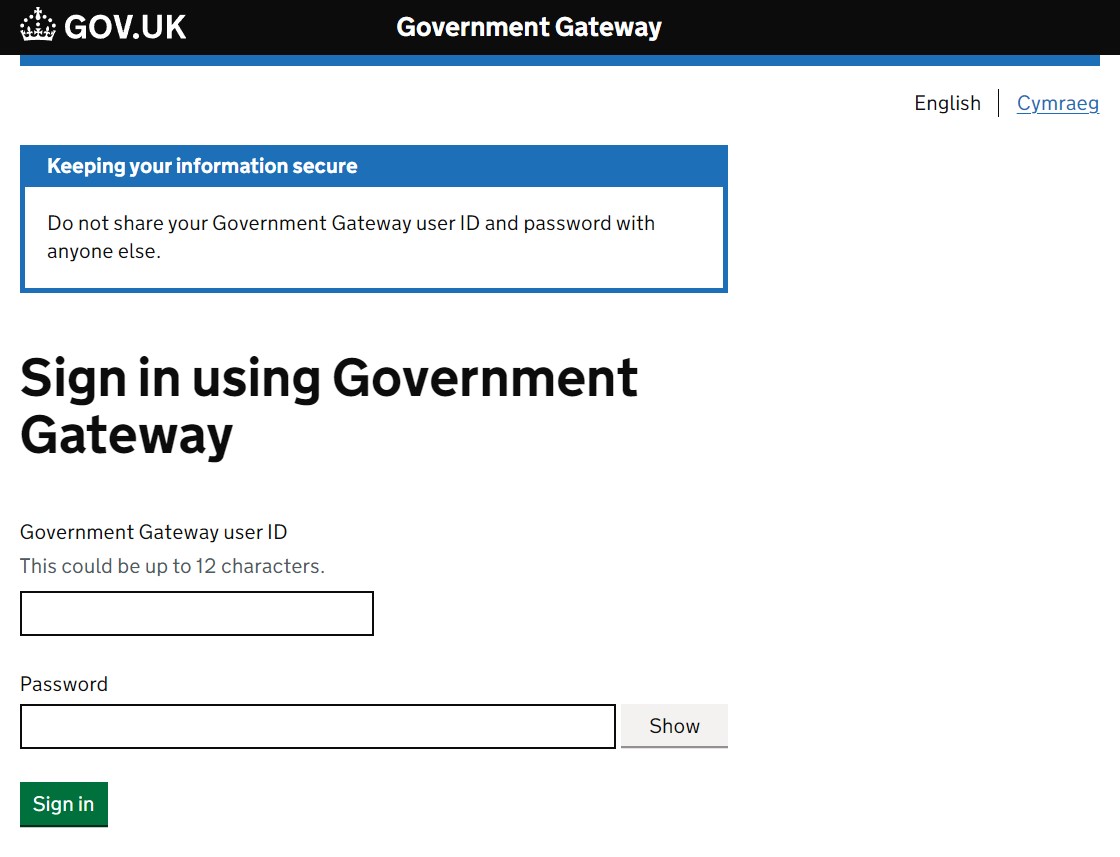

Amending tax returns: Should you discover an error in your tax return, you can make amendments. Changes can be submitted online via your Government Gateway account or by providing corrected pages if your original submission was made on paper.

Disputing HMRC errors: If HMRC makes an error, you have the option to contest it. This encompasses inaccuracies in tax calculations or the use of incorrect information.

Requesting refunds: If an error leads to an overpayment, you can request a refund. Your revised bill will incorporate any adjustments, and refunds will be processed accordingly.

Timely filing: Individuals and businesses are responsible for filing their taxes and other required documents accurately and on time.

Clear information: HMRC must provide clear and accurate information to help you understand your tax obligations.

Record keeping: Keep accurate records of your income, expenses, and other relevant financial information.

Communication: Notify HMRC of any alterations in your circumstances that could impact your tax status.

Payment: Pay the correct amount of tax by the due date. If penalties are imposed on you, make sure you pay them not to face legal consequences. Additionally, if corrections result in additional tax owed, you are responsible for paying the updated amount by a specified deadline.

Honesty: Provide accurate and complete information to HMRC.

What are the common HMRC errors?

Incorrect figures:

Miscalculating taxes can happen for many reasons. The UK tax system can be quite complex, with various allowances, reliefs, and rates that apply differently depending on individual circumstances. Additionally, if you’re calculating your taxes manually, there’s a higher risk of human error.

Business owners can also insert incorrect figures in the Pay As You Earn (PAYE) system. This involves the deduction of income tax and national insurance contributions from an employee’s salary. If one calculation is a mistake, the whole PAYE tax return will have errors.

Individuals who do not understand UK tax rules such as allocating personal reliefs or allowances can also lead to mistakes. Business owners must be up to date with tax rules, laws, and regulations and any changes that may apply.

Missed deadlines:

When an individual or a business owner misses to submit their tax returns, a penalty may be imposed on them. Sometimes there may be miscommunication between business owners and employees or accountants which may lead to missed deadlines. The business may also be undergoing financial difficulties which may delay filing taxes due to the inability to pay the owed amount.

The frequent changes and the complexities of tax laws may also make it difficult for businesses to stay up to date. A company can also not stay up to date due to a lack of organisation. This may make it difficult to keep track of all necessary documents and information delaying the filling process.

Incomplete information:

Incomplete information or corrupted data can cause errors. Incomplete information in tax credit renewal notices can cause errors in the calculation of benefits. Employers might also submit incorrect tax information about their employees which can result in incorrect tax deductions. It’s always a good idea to double-check any information submitted to HMRC to avoid these common pitfalls.

Consequences of HMRC errors?

Penalties: Penalties may be applied depending on the type of error committed. The severity of these penalties can differ based on whether the error was unintentional, negligent, or intentional. Penalty may be imposed through additional tax or interest on any unpaid tax. If an error leads to a tax underpayment, HMRC may necessitate the payment of the outstanding tax amount. Additionally, interest may accrue on any unpaid tax from the due date until full payment is made.

Legal consequences: In extreme situations, particularly when the mistake is considered intentional or fraudulent, legal measures may be pursued against the individual or entity involved.

Reputation damage: Engaging in legal disputes or investigations can negatively impact your reputation, especially for businesses.

Administrative burden: Rectifying errors will need time allocation and resources which could entail resubmitting documents or supplying supplementary information. Furthermore, such errors may prompt investigations or audits by HMRC, leading to a process that is both time-consuming and stressful.

Cash Flow issues: Unforeseen tax obligations and penalties may influence your cash flow, which could subsequently affect the operations of your business.

Loss of benefits: Mistakes in the calculation of tax credits may lead to the forfeiture of benefits or the necessity to repay any overpayments made.

How to amend a tax return?

You can amend a tax return via different methods. One can amend it online, through the HMRC app, or on paper.

To amend it online, you will have to;

- Log into your account using your Government Gateway user ID and password.

- From the ‘Your tax account’ section, select ‘Self Assessment tax account’ (skip this step if this option is not available).

- Click on ‘More Self Assessment details’.

- Choose ‘At a glance’.

- Navigate to ‘tax return options’.

- Select the tax year corresponding to the return you wish to amend.

- Make the necessary corrections in the return and submit it again.

To amend via the HMRC app, you will need to log in using your Government Gateway user ID if it is your first time accessing the app. If it is not your first time accessing the app, you can sign in using your phone’s fingerprint or facial recognition technology and a 6-digit PIN. Upon logging into the app, you will find a section labelled ‘Self Assessment’, where you can view any past or upcoming payments.

Alternatively, if you submitted your return in paper format, you will need to download a new tax return and send HMRC the pages that require correction. Indicate ‘amendment’ on each corrected page, and ensure that both your name and Unique Taxpayer Reference (UTR) are included (your UTR can be located in previous correspondence from HMRC). Mail it to HMRC at the address specified on your Self-Assessment documentation.

A waiting period of 72 hours is required after submission before any changes can be made, in addition to a specified deadline for such changes. Fortunately, this deadline is quite accommodating, so as long as you identify the necessary adjustments promptly, you should be fine. Following the submission of your revised tax return, you will receive an updated bill indicating whether you have a tax liability or are entitled to a refund.

How to challenge an HMRC mistake?

If you believe that HMRC has erred in processing your tax return, you have the option to contest their decision. This process is referred to as submitting a ‘notice of inquiry.’ To substantiate your assertion that HMRC has made an error, it is essential to provide supporting evidence. In the absence of such evidence, HMRC may not consider your grievance.

Evidence may include documents such as bank statements or payslips. Maintaining accurate financial records is vital for everyone, but it is particularly essential for self-employed individuals. The tax obligations for self-employed persons differ from those of employed individuals. HMRC reserves the right to request access to your records at any time.

To initiate a notice of inquiry, you should reach out to HMRC directly. Once you have submitted your evidence, HMRC will evaluate your case and conclude. Should they concur that a mistake has occurred, they will rectify it and issue a refund if necessary.

If you find HMRC’s decision unsatisfactory, you have the right to appeal by sending a written request within 30 days. This typically requires you to provide a written explanation detailing the reasons for your appeal, along with any supporting evidence. Additionally, you may request an oral hearing if you believe it would be beneficial.

In the absence of such evidence, HMRC may not consider your grievance.

Conclusion

In conclusion, making a mistake on your taxes can lead to hefty consequences that can negatively affect your business. However, you can avoid these penalties by referring to the HMRC errors and mistakes guidance, communicating with HMRC promptly, and rectifying the errors within a given deadline.

If the tax law complexities are confusing you, you can seek advice from company formation agents like BusinAssist who can guide you in dealing with HMRC. We can help businesses file corporate tax returns and VAT. We can also help in registering for VAT and EORI numbers.

We also offer a London virtual office address that can be used as a registered address which a company will need to receive official notification from HMRC and other government agencies.

For more information, contact us at info@businassist.com.

Read Also:

- Companies House Authentication Code: What You Need to Know

- When Do I Need to Register My Business with HMRC? A Guide for New Entrepreneurs

- How Long Do You Have to Keep Records for HMRC? A Guide for UK Businesses

- Everything You Need to Know About Companies House Default Address

- Understanding the Timeline: How Long Does It Take to Get a Tax Refund After Self-Assessment?

- Should I Trademark My Business Name UK? What You Need to Know

- Lost Your Government Gateway User ID and Password? Here’s How to Find Them

- Can HMRC Access Your Bank Account? What Every Taxpayer Should Know

- Why would a Company Register a Charge with Companies House?

The BusinAssist Editorial Team has 15+ years of experience writing about small business and company formation in the UK, Canada, and the USA. We simplify complex processes and provide practical insights to help entrepreneurs succeed. Business Assist with BusinAssist – your partner for business success.