Last Updated on December 22, 2025 by Joy Kyalo

Once a limited company is incorporated, some decisions will need a company resolution. A company resolution takes different forms when making decisions that go beyond the daily business operations. Resolutions are legally binding decisions made by members of the company, such as directors and shareholders.

Decisions that may require company resolution include the removal and appointment of directors, mergers and acquisitions, share transfers, and approval of major contracts, among others. However, all company decisions necessitate different types of resolutions, which will be explained in this article, including how and when they are used.

Key Takeaways

- Company resolutions are legally binding decisions required for major company actions beyond daily operations.

- Different decisions require ordinary, special, written, or board resolutions under the Companies Act 2006.

- Ordinary resolutions need 50%, while special resolutions require 75% shareholder approva

- Some resolutions must be filed with Companies House within 15 days to stay compliant.

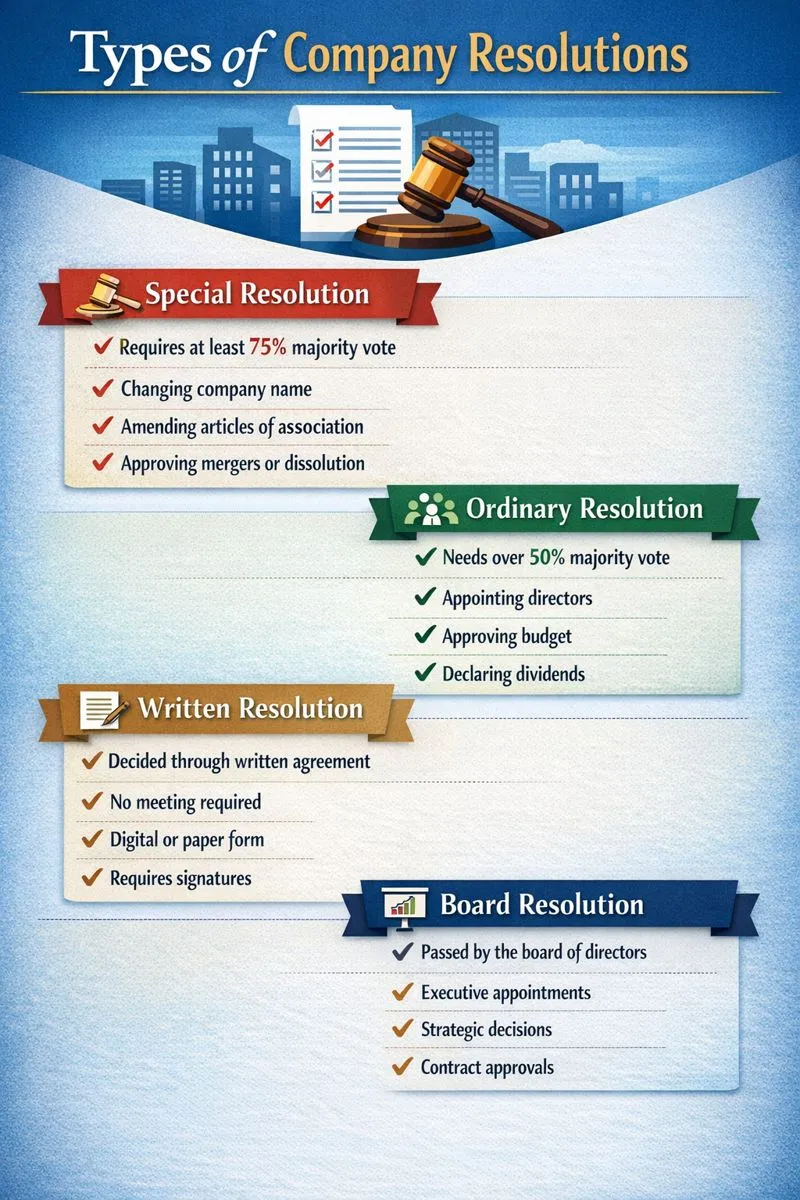

Types of company resolution

Company resolution comes in different types. Company directors and shareholders need to understand which type is appropriate to be used in every decision-making process. The process of making a company decision must align with the Companies Act 2006 and articles of association. They often specify the type of resolution required for every decision.

The company resolution includes;

- Special resolution

- Ordinary resolution

- Written resolution

- Board resolution

Ordinary resolution

This resolution is used when the company’s directors or shareholders make decisions. To be passed, the resolution needs a simple majority vote. The simple majority vote cast should be more than 50% in favor of the motion. The resolution can be passed through a written vote or a meeting.

Decisions approved through ordinary resolution include:

- Approving the administrative budget

- Appointing or removing a company secretary

- Appointing auditors

- Changing the director’s contract

- Approving loans

- Authorising companies’ share buy-back

- Authorising shareholders’ dividend payment

- Increasing and authorising share capital

Special resolution

A special resolution is used to pass critical company decisions that need 75% votes. Unlike ordinary resolution, special resolution is reserved for important decisions that can significantly affect governance, operations, and company structure.

This process involves formal proposals, meetings, or written resolution discussions, and a vote.

Decisions approved through special resolution include;

- Changing company name

- Amending articles and memorandum of association

- Allotting share transfer

- Amending shareholders’ agreement

- Share transfer approval

- Authorisation of directors’ compensation

- Dissolving the company

- Appointing the board of directors’ chairperson

- Reducing or increasing the company’s capital structure

- Changing company structure

- Amending the company’s objectives

- Approving mergers and acquisitions

- Change of registered office address

Written resolution

A written resolution can come in two ways: by shareholders or directors. The written resolution is a convenient way to pass a decision without a general meeting. Unless stated otherwise in the articles of association, almost all company decisions can be passed through a written resolution. It is only covered in private companies. Public limited companies may be required to hold a general meeting to pass a company resolution unless it is specifically allowed in the articles of association.

The requirements of passing a written resolution are the same as those of ordinary and specialised resolutions. It will require more than 50% simple majority in an ordinary resolution and more than 75% for a special resolution.

A written resolution is passed by sending a proposal for the decision to be made across the shareholders and directors digitally or through a hard copy. The proposal must include the resolution being requested, an accompanying statement, and the signatures of those making the request.

Board of resolution

Also known as a director’s resolution, a board resolution is a formal decision made by the board of directors. It is often passed through a board meeting with a simple majority. However, if the articles of association require a higher majority or unanimous approval through board resolution.

Board resolution can also be passed through a written resolution, unless prohibited. The resolution can be used in making decisions such as;

- Approving budgets

- Appointing executives

- Entering contracts

Here is a voting table of a written or a meeting resolution

| Shareholders | Shares | Meeting voting | Written resolution |

| Theodore | 30% | Yes | Yes |

| Karen | 25% | Yes | Yes |

| Alex | 20% | Didn’t attend or vote | No |

| Christopher | 15% | No | No |

| Susan | 10% | No | No |

| Total votes for the proposal | 55% | 55% |

| Total votes against the proposal | 25% | 45% |

| Percentage of votes for the proposal | 75% | 55% |

| Outcome of the resolution | Passed | Passed |

When to file a company resolution with Companies House

Once a company resolution is passed, especially a special resolution, Companies House must be notified within 15 days of being passed.

Ordinary resolutions do not need to be filed with Companies House, but they must be recorded and stored in the company records either at the registered office address or Single Alternative Inspection Location (SAIL) and made available for inspection upon request. The resolution records must be kept for a minimum of 10 years from the date passed.

Some of the decisions may require the company to complete certain forms and submit them to Companies House, such as TM01, TM02, SH01, NM01, PSC04, among others, depending on the decision made.

In conclusion, the above are the different types of company resolutions depending on the proposal being passed. It is essential to understand the Companies Act 2006 and articles of association to understand which decisions require every type of resolution.

Once a resolution has been made, it is essential to file with Companies House within the specified time, which is 15 days.

BusinAssist can help file company changes with Companies House, including the appointment and removal of directors, secretaries, shareholders, and PSCs, as well as company name changes, share transfers, and other updates.

For any company structural changes, contact us at info@businassist.com.

FAQs

Q: How to write a company resolution?

Ans: A written resolution or holding a general meeting are the two ways by which a company resolution can be passed. A written company resolution must include;

- An explanation of whether it is an ordinary or special home resolution

- Explanation of the resolution

- Description of shareholders’ agreement

- The date of passing the resolution

- Signatures of directors or shareholders who have agreed with the resolution.

Q: What is a company resolution document?

Ans: This is a legal document that records major decisions of the company’s shareholders and directors.

Q: How to draft a resolution for a company?

Ans: A headline, an introduction, and the operative section are the three components of a company resolution. The headline contains the type of resolution being passed: ordinary, special, or board resolution.

The introduction statement includes the date, time, and location. It should also provide a background of the resolution.

The operative section must have the exact decision being made on the resolution. It should contain the names of members authorised to act on the decision, steps to be taken, and the effective date of the decision.

For a written resolution, it should have signatures and names of all those members who agree with the resolution.

Q: How to challenge a company resolution in the UK?

Ans: To challenge a company resolution in the UK, you typically have to understand the Companies Act 2006, which states the provisions of challenging a company resolution. Depending on the company resolution that needs to be challenged, the company can apply to the High Court, mediation, or arbitration.

Q: What if the director acts on an invalid company resolution?

Ans: If a director acts on an invalid company resolution, the resolution will be invalid. The director may also face consequences since they will be liable for any loss incurred by the company or third parties.

Q: What is a limited liability company resolution?

Ans: An LLC resolution is a document describing an action taken by the managers or owners of a company, with a statement regarding the issue that needs to be voted on.

Read Also:

- What Is an Authorised Corporate Service Provider (ACSP) and Why Does It Matter for UK Companies?

- Revolut vs Monzo: Which Is Right for You?

- How Many Bank Holidays in 2026? Full List of UK Dates You Should Know

- Someone Has Registered a Company at My Address in the UK – Understanding Your Rights

- Understanding Your Rights: What to Do If Your Employer Doesn’t Issue a P45

- How to Find Trending Products on E-commerce Marketplaces: A Guide for Online Sellers

- Should I Use My Home Address When Registering and Running My Business?

- How to Buy a Business with No Money: Creative Financing Strategies for Entrepreneurs

- A Complete Guide to Companies House Director Identity Verification

Joy is a content writer at BusinAssist with 6+ years of experience in content marketing and social media strategy. She specialises in company formation and virtual operations, guiding entrepreneurs through global markets with clarity, drawing on her marketing and PR background. Business Assist with BusinAssist – your business success partner.