Last Updated on July 9, 2025 by Joy Kyalo

An Economic Operator Registration and Identification (EORI) number is an identification number assigned to businesses engaged in import and export activities.

Businesses operating within the United Kingdom of Great Britain and Northern Ireland must provide an EORI number at customs when making import and export declarations.

What is a customs declaration? In simpler terms, a customs declaration is a document that lists all goods being imported or exported to be placed under a given customs procedure.

Introduced in 2009, an EORI number makes your import and export activities with the customs authorities easier.

Wondering if an EORI number is a requirement in your business? Read through the article to find out. This guide will cover who needs an EORI number, its purpose, and other specific requirements.

Is the UK VAT number or Tax ID the same as the EORI number?

A Tax ID, an EORI, and a VAT number are different. A tax ID is used to file tax returns ( in the UK a tax ID is referred as UTR i.e. Unique Taxpayer Reference), a VAT number is used to purchase and sell VAT-registered goods and services, and an EORI number identifies companies doing business in the EU.

Tax ID / UTR is issued to businesses for corporation tax, VAT to businesses involved in cross-border transactions, and an EORI number is issued to businesses involved in import and export activities.

A VAT number is placed on your EORI number if you are VAT registered.

What is an EORI used for?

- For custom clearance

- To track goods in and out of Europe

- To assist with qualifying for trade agreements and claiming preferential origin under the EU-UK Trade Cooperation Agreement

Who needs an EORI number?

Not all businesses in the UK are required to have an EORI number apart from those who import and export goods in or out of the European Union.

Businesses may need an EORI number if they move goods

- Between Great Britain and Northern Ireland.

- Between Great Britain (England, Scotland, and Wales) or the Isle of Man and any other country (including the EU).

- Between Great Britain (England, Scotland, and Wales) or the Isle of Man and any other country (including the EU).

- Between Northern Ireland and countries outside the EU.

- Between Great Britain and the Channel Islands.

Businesses that make a customs declaration by using customs systems, such as the CHIEF system and the Import Control System Northern Ireland (ICS NI) may need an EORI number.

If your business is based in the country where you’re importing or exporting from you may need an EORI number. However, the company must be a registered office, a central headquarters, or a permanent business establishment where customs-related activities occur, and HR and technical resources are permanently located.

Even if your business is not based in the relevant country, you should still get an EORI number if you’re:

- Making customs declarations (e.g., for transit, temporary admission)

- Applying for customs decisions

- Acting as a carrier for transporting goods by sea, inland waterway, or air

- Connected to the customs system and want notifications regarding declarations

- Established in a common transit country where declarations are lodged.

Does an EORI number affect serviced-based companies?

An EORI number only applies to companies involved in the import and export of physical goods. You may not need an EORI if your company offers services such as consulting.

However, if your service-based company starts importing or exporting physical goods you will need to register for an EORI number before you start shipping.

Where can you get an EORI number?

An EORI number is assigned by HM Revenue and Customs (HMRC) which oversees customs declarations, duties, and tariffs for businesses involved in international trade.

How can my business get an EORI number?

If your business is based in the UK, you will need the necessary documents to get an EORI number. When applying, you will need:

- Your Unique Taxpayer Reference (UTR). If you do not know it, you can find it on Companies House website.

- Business start date and Standard Industrial Classification (SIC) code. These are on Companies House register.

- Government Gateway user ID and password

- VAT number and effective date of registration (if you are VAT registered). These are on your VAT registration certificate.

- National Insurance number

If your business is not based in the UK, you do not need a UTR, a SIC code, or a National Insurance number.

If you do not already have a Government Gateway user ID, you’ll be able to create one when you apply.

The process of applying for an EORI number can be confusing for someone new to the process. With minimum documentation requirements, we can help you get an EORI number quickly, whether you are a UK or non-UK resident at an affordable rate.

How long will it take to get my EORI number?

Making an online application to get an EORI number can take up to 2 to 3 hours. However, the time can differ if HMRC needs to perform any additional checks. If they do, it may take up to five working days.

You can check your EORI number using an EORI number-checking service once the application has been processed.

What is the format of an EORI number?

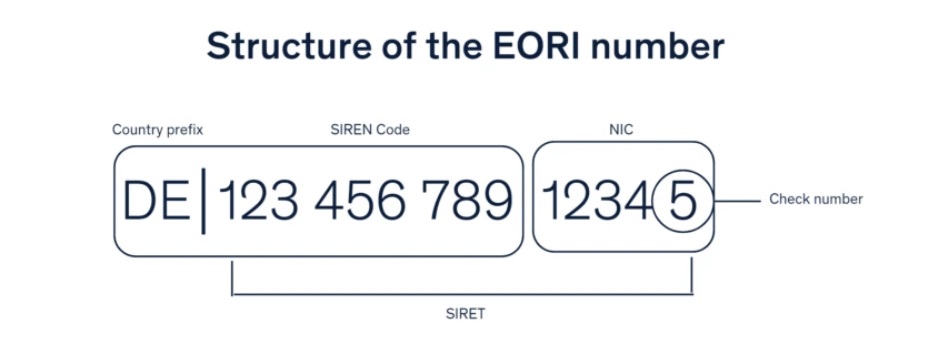

An EORI number differs from one country to another since it is issued by the customs authorities of the specific country where your business is based.

It consists of two parts: the country code of the issuing member state followed by your VAT number (if you are VAT registered). If you are not VAT registered then the VAT number will be replaced with a unique number or code.

The type of EORI number you should use depends on where you’re moving goods to and from.

If you are trading out of Great Britain, you will need an EORI number starting with GB, (for example: GB548567834836).

For businesses moving goods to or from Northern Ireland, you will need an EORI number starting with XI, (for example: XI123456654321)

EU EORI numbers are 3-17 characters long starting with the respective two-letter country code, for example, (FR67890988907654) for France. The code identifies businesses engaged in international trade, customs operations, and related activities.

An incorrect EORI number can delay your consignment to be released by the customs department.

Where do I include an EORI number?

You will need to include your EORI number on the commercial invoice and packing list documentation.

Under which circumstances do I not need an EORI number?

You do not need an EORI number if you’re moving goods that are not controlled (goods that don’t fall under specific regulatory restrictions). You also do not need an EORI number if the goods you’re moving are strictly for personal use.

If you’re based in the Channel Islands and move goods to or from the UK, you do not need an EORI number unless you use HMRC’s customs systems like Customs Handling of Import and Export Freight (CHIEF).

What are the consequences of not getting an EORI number for my business?

If you don’t get an EORI number for your business you will incur heavy fees for any custom clearance, return shipping, and storage. Additionally, your goods will be stuck at the border and you will not be able to access them.

Your business will experience delays causing operational challenges, customer dissatisfaction, and financial losses.

How many times do I need to apply for an EORI number?

You will only need to apply for an EORI number once per business, that is if your business expands into other countries and you are required to hold an EORI number issued by those countries. Also, an EORI number does not expire and is valid for all your import and export activities within the EU.

Can a company in the EU and UK have more than one EORI number?

Yes, it can. If a company operates both in the UK and EU, it can have dual EORI numbers.

You can have an EU EORI number for transactions within countries in the EU member states and a UK EORI number for transactions in the UK.

When is an EORI number required?

An EORI number will be required when:

- You appoint someone to deal with customs on your behalf.

- Use customs systems such as the Customs Handling of Import and Export Freight (CHIEF) system and the Import Control System Northern Ireland (ICS NI)

- Apply for a customs decision.

- Make customs declarations

Why is an EORI number important?

- Smooth import and export transaction: An EORI number makes the process of moving goods smooth by minimising administrative hurdles.

- Easier customs procedure: An EORI number is used to declare goods at the customs. The number makes the process easier with customs authorities eliminating the risk of delays.

- Simplifies compliance with legal requirements: An EORI number ensures you adhere to the legal requirements of international trade.

- Access to special custom procedures: Your business may benefit from inward process relief and custom warehousing.

- Enhance business security: With an EORI number, it is easier for customs authorities to curb illegal trading activities at the border.

Is it possible to make changes to my EORI details?

To update your EORI details, you will need to contact HMRC and provide them with the necessary information such as:

- Your existing EORI number

- Company name

- VAT number

- Business address

- Changes to be made in the EORI document

The list is not exhausted. You can provide all the information HMRC asks for.

An EORI number is crucial to navigate import and export activities within the EU. With an EORI number, you will not experience delays or have frustrations at the border.

It is important to note that EORI numbers are only for goods and not for services such as consulting. However, if your service-based company starts importing or exporting physical goods you will need to register for an EORI number before you start shipping.

You can obtain an EORI number with BusinAssist to save you time and hassle. If you also need a VAT number, we do the registration for you and file returns at an affordable price.

Have any unanswered questions? Contact us today at info@BusinAssist.com and learn more about an EORI number.

Read Also:

- What is a VAT registration number? – A complete guide

- Do Private Individuals Need an EORI Number? How to Get One Explained

- Understanding the Importance of a Tax Identification Number in the UK

- Understanding the Timeline: How Long Does It Take to Get a Tax Refund After Self-Assessment?

- What Are the Disadvantages of a Dormant Company?

- Everything You Need to Know About Companies House Default Address

- How to Get an EORI Number Fast: A Guide for UK Traders

- What is Postal Fraud and How can BusinAssist Help me From Being a Target?

- How Long Do You Have to Keep Records for HMRC? A Guide for UK Businesses

The BusinAssist Editorial Team has 15+ years of experience writing about small business and company formation in the UK, Canada, and the USA. We simplify complex processes and provide practical insights to help entrepreneurs succeed. Business Assist with BusinAssist – your partner for business success.