Last Updated on November 28, 2025 by Joy Kyalo

Register your UK Company from India for just £50.99. Place your order now!

Many Indian business owners are now looking at how to register a company in UK from India, especially with the UK-India Free Trade Agreement making trade easier.

This growing partnership is opening new doors for Indian entrepreneurs who want to expand into the UK market. And that is why so many are now asking, “how to start a business in UK from India?”

In this guide, we will show you how to register a company in UK from India in simple steps.

Key Takeaways

- Indians can register a UK Pvt Ltd company online without UK residency or visa.

- Just choose a name, appoint directors, and use a UK virtual address

- Tax registration and banking can be handled remotely from India.

- Enjoy global credibility, tax perks, and UK-India trade benefits.

Can Indians Legally Register a Company in the UK?

Yes, Indian citizens can register a UK company. There is no need to live there. You don’t need UK citizenship, residency, a visa, or a National Insurance Number.

All you need:

• One director (can be Indian)

• One shareholder (can be the same person)

• A UK office address (virtual address works)

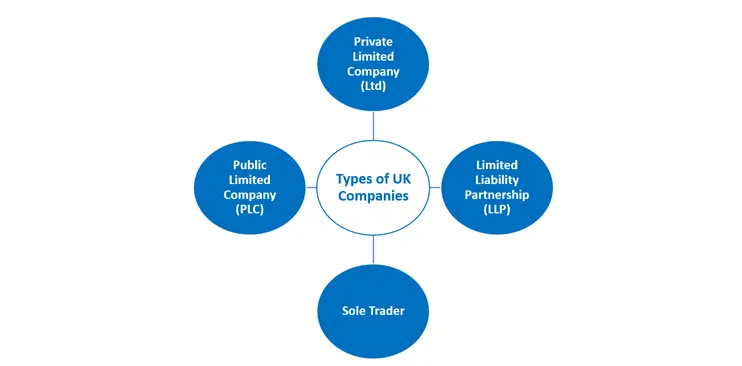

Types of UK Companies You Can Register

Before you begin, pick the right company type. Here are the main options in the UK:

- Private Limited Company (Ltd): It’s a separate legal entity, so your personal assets stay safe.

- Limited Liability Partnership (LLP): Ideal for two or more partners with limited risks to their share.

- Sole Trader: You own the business fully and keep all profits but also carry all risks.

- Public Limited Company (PLC): For bigger businesses that want public investors.

Which one should you choose?

If you are starting from India and want to run your business remotely, a Private Limited Company (Ltd) is usually the best choice.

Next, let’s discuss how to start a business in the UK from India.

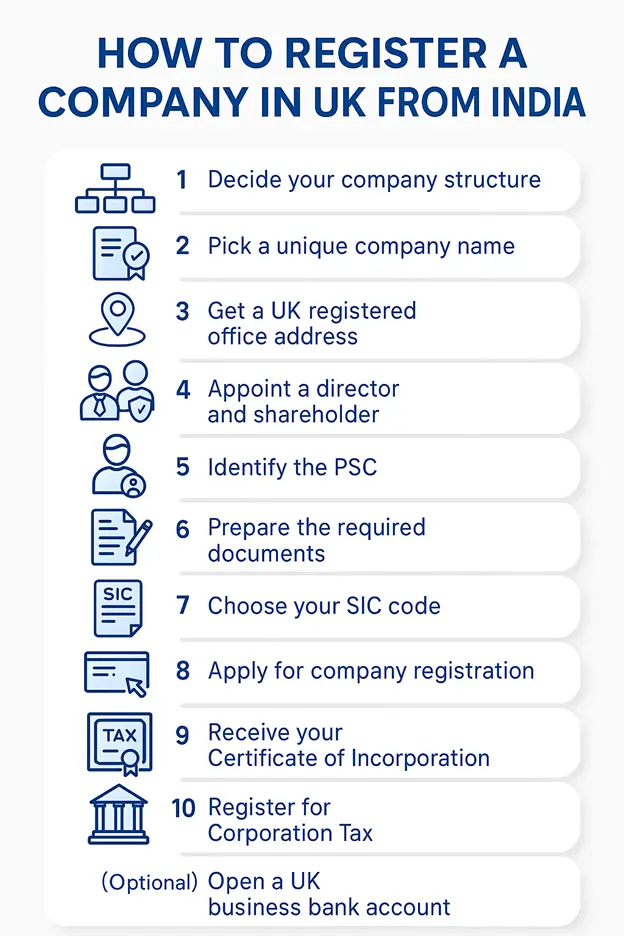

Step-by-Step Process: How to Register a Company in the UK from India?

Now, let’s start with the main part of the blog, i.e. how to register a company in the UK from India?

- Decide your company structure

The first step is always choosing your company type. For most Indian entrepreneurs, a Private Limited Company is the most suitable option. It offers limited liability, 100% foreign ownership, and is easy to set up.

Pro Tip: Simplify Your UK Company Registration from India

Register your UK company entirely online by choosing the right structure, securing a virtual UK address, and appointing directors – using a reliable formation service can speed up the process and minimize paperwork.

- Pick a unique company name

Next, pick a unique name that represents your brand, so choose wisely.

Your name must be:

• Unique

• Not offensive

• Not too similar to another company

Simply enter the name in the Company name availability checker.

- Get a UK registered office address

To register a UK company, a UK virtual office address is required, even if you live in India.

Why?

Because legal and government letters go there.

Don’t have one?

Use a UK virtual office. It’s affordable and gives you a real UK address for:

• Company registration

• HMRC and Companies House mail

- Appoint a director and shareholder

Next, choose who will run and own your company. Every UK company needs:

• At least one director

• At least one shareholder

They can be the same person, and don’t need to live in the UK.

You’ll need to share their:

• Full name

• Address (can be Indian)

• Date of birth

• Occupation

• Nationality

- Identify the PSC (person with significant control)

UK companies must reveal who really controls the business – called a PSC.

A PSC is someone who:

• Owns over 25% of shares or votes

• Can appoint or remove directors

Usually, it’s the shareholder. You must report their details to Companies House.

- Prepare the required documents

Before registering, you’ll need to submit a few legal documents to Companies House:

• Memorandum of Association

• Articles of Association

• Proof of ID and address

• Details of directors, shareholders, and PSCs

It can get tricky, so most people use a UK company formation service. They handle it all for you.

- Choose the SIC code

Every UK company needs a SIC code. It tells the government what your business does.

SIC = Standard Industrial Classification.

Example:

• 62020 = IT consultancy

• 82990 = Business support services

You can search your SIC code on the Companies House website.

- Apply for company registration with Companies House

Once you have everything ready, it’s time to register:

• Directly with Companies House

• Or use a service like BusinAssist for faster help

Here is the fee structure for company registration.

| Company Type | Online/Software Fee | Paper Application Fee |

|---|---|---|

| Private Limited Company (Ltd) | £50 | £71 |

| Limited Liability Partnership (LLP) | £50 | £71 |

| Overseas Company – UK Establishment | — | £71 |

| Community Interest Company (CIC) | £65 | £86 |

*As of 19 July, 2025.

Once submitted, registration is usually completed within 24 hours. However, in a few cases, it can take weeks as well.

- Receive your Certificate of Incorporation

After you apply, just wait for approval. Once accepted, you’ll get key documents like:

• Company Registration Number (CRN)

• Certificate of Incorporation

• Proof your business is legally registered

You’ll need this for:

- Opening a UK bank account

- Signing contracts

- Applying for a visa – if moving to UK

- Register for Corporation Tax

You must now register for Corporation Tax within 3 months of starting business activities, like buying stock or invoicing clients.

You can do this online using your Government Gateway account. HMRC will then send you a Unique Taxpayer Reference (UTR) and confirm your registration.

- Open a UK business bank account (Optional)

This step is optional, but important. You’ll need a UK bank account to receive payments, so we strongly recommend it. Some banks even let non-resident directors open accounts remotely. Its handy if you’re running things from India.

That’s it on how to start a UK business from India!

Costs Involved in Registering a UK Company from India

Now that you already know how to start a business in UK from India, let’s discuss about the cost of registration.

| Expense | Cost (Approx.) |

|---|---|

| Company Registration (Ltd) | £50 (online) |

| Same Day Registration (Ltd) | £78 |

| Virtual Office Address | From £0.88 per week |

| Company Formation Service | £0.99 (one-time) |

| UK Business Bank Account (Optional) | £0 to £20 per month |

| Accounting & Tax Services | £200 to £500 per year |

Can You Run a UK Business from India Remotely?

Yes, you can run a UK business from India. You don’t need to live in the UK. Register your UK company, get a UK address (a UK virtual address works), and manage everything online.

Post-Registration Checklist – What Happens Next?

After registration, there are a few important steps run your UK Company smoothly from India.

| Task | When | Why It Is Important |

|---|---|---|

| Register for Corporation Tax | Within 3 months | Legal requirement for UK companies |

| Open a UK business bank account | As soon as possible | Helps manage business finances |

| Set up accounting | Immediately after setup | Required for annual filings and tax |

| File confirmation statement | Every 12 months | Confirms your company details |

| File annual accounts | Each financial year end | Mandatory for compliance |

| Pay Corporation Tax | 9 months after year end | Avoid penalties from HMRC |

| Register for VAT | If turnover > £90,000 | Legal threshold for VAT registration |

Why Start a Business in the UK from India?

Here are some reasons why so many Indian nationals are starting business in the UK.

- Simple and fast online company registration

- Strong trade ties through the UK-India Free Trade Agreement

- Global credibility and better trust from investors

- Access to funding and grants

- Stable political and legal environment

- English-speaking business ecosystem

- Easy to operate remotely with a virtual office

- Gateway to the European and US markets

- Low corporate tax compared to many countries

“The recent announcement of the conclusion of the Free Trade Agreement negotiations will turbo-charge this relationship further and leads us into a golden era of India/UK trade, which we can all look forward to.”

– Manoj Ladwa, Founder Chairman and CEO of The India Global Forum

Conclusion: Starting a UK Company from India Made Easy

And that’s a wrap on “how to register a company in the UK from India?”

The entire process might seem difficult but with the right approach, you can register your business online in under 24 hours. The best part? You can do it all from India.

And if you would rather not go through the hassle alone, there are services like BusinAssist that can help you register your company and even give you a UK address to use.

We offer UK Company Formation services starting from just £0.99, and if you take one of our UK virtual office address packages starting at just £0.88 per week, we will register your UK company for free.

You will also get access to UK address options, help with documentation, and even UK bank account setup support, all handled from India.

Contact us at info@businassist.com to get your company registered.

Read Also:

- How to Start a UK Ltd Company from Pakistan: Step-by-Step Guide

- How Much Does It Cost to Set Up a Limited Company UK?

- Start a UK Company: A Simple Guide from Idea to Setup (2025 Edition)

- Do I Need a Registered Business to Sell on Etsy? A Simple Guide for Beginners

- Someone Has Registered a Company at My Address in the UK – Understanding Your Rights

- Understanding Your Rights: What to Do If Your Employer Doesn’t Issue a P45

- How Long Do You Have to Keep Records for HMRC? A Guide for UK Businesses

- Can HMRC Access Your Bank Account? What Every Taxpayer Should Know

- What is a Tax Office Reference Number and How Can I Find It?

- How to Incorporate a Company in the UK: Key Steps and Requirements

- Company Registration Scotland: Your Complete Guide to Scottish Limited Company Formation

Iram Shaikh is a content writer focused on business, marketing, and technology. She specializes in turning complex ideas into clear, practical insights. Her work is shaped by hands-on experience and curiosity. She aims to inform, engage, and simplify with every article.