Last Updated on December 17, 2025 by Joy Kyalo

Get your EORI Number Today for just £24.99 inc VAT. Place Order Now!

Trading goods from one border to another requires a unique identifier code to ensure your standardised classification of goods by the customs authority. In this case, if you want to trade in the European Union (EU) and Great Britain you’ll need to obtain the Economic Operators Registration and Identification (EORI) number.

An EORI number is used by customs authorities to identify businesses involved in trading activities in the UK and the EU countries. This article will guide traders on how to get an EORI number fast, what it looks like, and why you need it as a UK trader.

Key Takeaways

- An EORI number is mandatory for trading goods between Great Britain and the EU borders.

- It speeds up customs clearance and prevents costly shipping delays.

- Easy to get online through a Government Gateway account; VAT registration is not always required.

- Not needed for personal imports, digital-only sales, or trade with non-EU countries.

Who needs an EORI number?

An EORI number is necessary for businesses involved in trading activities within the EU and the UK, whether sole traders or limited companies.

Businesses need an EORI number if trading goods in:

- Great Britain (England, Scotland, Wales), the Isle of Man and any other country (including the European Union).

- Great Britain and Northern Ireland

- Great Britain and the Channel Islands

- Northern Ireland and countries outside the EU

Additionally, if you use freight forwarders or customs agents to help ship goods, you will need an EORI number for clearance.

Now that we understand who needs an EORI number, let’s find its importance in the next section.

Why do you need an EORI number?

Customs clearance: For goods to be cleared at the border, customs authorities will need an EORI number.

Efficiency: It allows for quick customs clearance of your goods within the EU, creating efficiency between the customs authorities and the traders.

Ease communications: An EORI number eases communication with customs authorities. Immediately you offer them the number, they will automatically identify your business improving information exchange.

Trade compliance: The EORI number helps traders comply with the EU and UK’s legal trade regulations.

Identification: Customs authorities, freighters, importers and exporters need an EORI number to identify every business and individual involved in international trading within the UK and EU.

What does an EORI number look like?

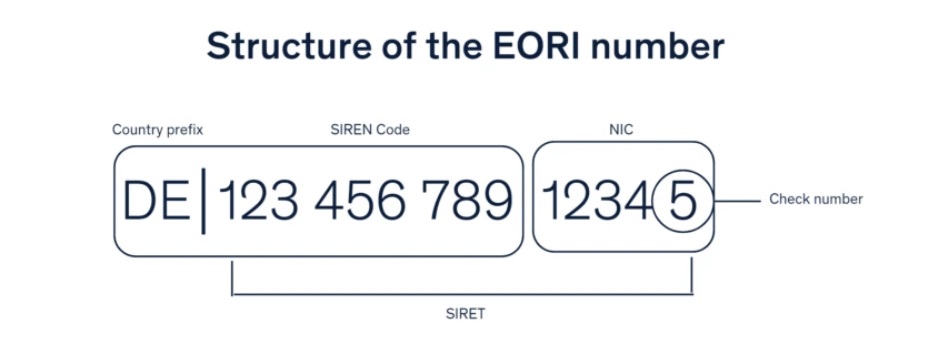

We now know who needs an EORI number and its importance, but we don’t know what it looks like. An EORI number differs from country to country since they are obtained from the jurisdiction where you are trading.

An EORI number is inclusive of a VAT number but only for businesses that have registered for it. For those not registered, the part of the VAT number will be replaced with an HMRC code.

VAT-registered businesses trading out of Great Britain, their EORI number will include the country’s prefix, VAT number and three digits at the end. (GB + 456789342 + 000).

For businesses with no VAT number, the EORI number will be (GB + unique number).

EU businesses trading in the UK have their EORI number, which differs from that of Great Britain. Their prefix will be XI (Northern Ireland), DE (German), and FR (French). So, for German businesses trading in the UK, their EORI number will look like (DE879523567835).

Do I need an EORI number?

Whether you need an EORI number or not depends on the trading activities your business is involved in. You will definitely require an EORI number if you are an economic operator within the UK and EU. You will not need an EORI number if:

- Selling digital products

- Importing and exporting goods for personal use

- If you are trading with countries outside the EU, such as the USA, Japan, China, and many more.

Which EORI number should I obtain?

It is crucial to obtain the accurate EORI number to avoid confusion or being held up at customs. Here is a step-by-step guide on how to identify the EORI number you require: Here is how to determine which EORI number you need:

- Economic operators operating in Great Britain will need GB EORI number.

- The European Union has a specific number for transporting goods between its member countries that starts with XI.

Do I need a VAT number for an EORI number?

While having a VAT number helps your business reclaim VAT charged on the products you have bought from suppliers or manufacturers, you do not require it to obtain an EORI number.

If you registered for a VAT number before obtaining an EORI number, the VAT code will be added. Businesses with an EORI number but don’t have a VAT number and whose annual taxable turnover has exceeded the threshold, will have to deregister the EORI number to get a new one with the VAT number.

What do I need to get an EORI number?

- Unique Taxpayer Reference (UTR)

- Business start date

- Standard Industrial Classification (SIC) code

- VAT number (if applicable)

- National Insurance number (for sole traders)

Non-UK businesses do not require a SIC code or a UTR number. The business owners can obtain the EORI number through the Government Gateway, where they will get it.

How to get an EORI number?

You can obtain an EORI number within hours unless HMRC has to verify your information. If applying for an EU EORI, you must apply for a GB EORI number before getting an XI EORI number.

To obtain an EORI number, you will need;

- XI VAT number (if applicable) issued by any EU country

- Proof of your permanent business

To obtain an EORI number, you will need to understand the legal requirements of customs and trading in Britain and the EU. The EORI number can be obtained through a Government Gateway account.

Pro Tip: Avoid Common EORI Mistakes

When applying for an EORI number, ensure your business details match exactly with HMRC records to avoid delays. You don’t need to be VAT registered, and most applications are processed within a few hours. For a smoother experience, consider using a professional service to handle the process on your behalf.

BusinAssist offers EORI number registration services with minimum documentation requirements at an affordable rate. You only get to fill in your business details on our online application form, and we will do the rest to ensure you get the EORI number.

We also have a Government Gateway account service, which is used to obtain an EORI number and access several services for your business, from a business tax account, customs declaration, and VAT to Corporation Tax and many more. Once your account is created, we will send you all the login details to ensure a seamless handover process.

With our user-friendly website, you can quickly fill out your information on our application form, and pay for services, and we will help you do the rest. The EORI number can be ready within 2-3 hours unless HMRC wants to verify some of your information, which may take 5 working days maximum.

Once approved, we will send you your EORI number to your Email, which you can include in your invoices and other customs declaration documents. You can also check if you are registered by using an EORI number checker service.

Conclusion:

So, how to get an EORI number? Getting an EORI number is fast and easy. If you are not familiar with the legal regulations involved, you can use third-party services such as those of BusinAssist to ensure your business’s compliance.

If you are dealing in trading activities for commercial purposes in Great Britain and the European Union, you must obtain an EORI number for customs declarations.

Contact us at info@businassist.com to get an EORI number.

FAQs

Q: Does my VAT number have EORI status?

Ans: A VAT number does not have EORI status. However, an EORI number has a VAT number for businesses that have registered for it.

Q: Does an individual need an EORI number?

Ans: An individual does not need an EORI number especially if they are importing goods for personal purposes. If an individual is self-employed and imports or exports goods in the UK or EU for business purposes, they will need an EORI number.

Q: Does an EORI number expire?

Ans: An EORI number does not expire. Once allocated to a business, the number remains valid indefinitely.

Q: Do you need an EORI number to import?

Ans: Yes, you will need an EORI number to import goods in Great Britain and the EU.

Q: Can you have more than one EORI number?

Ans: An economic operator can only have one EORI number for customs clearance.

Q: Can I use someone else’s EORI number?

Ans: No, you cannot use someone else’s EORI number. Each economic operator involved in import and export in the EU can only use its EORI number.

Q: Can I import goods without an EORI number?

Ans: You cannot import goods into or out of the EU and Great Britain without an EORI number.

Q: Can I get an EORI number without being VAT registered?

Ans: You can obtain an EORI number without being VAT registered. You will have to fill out the C220A form to get the EORI number.

Read Also:

- Do Private Individuals Need an EORI Number? How to Get One Explained

- What is an EORI Number? – A Guide

- Understanding Your Rights: What to Do If Your Employer Doesn’t Issue a P45

- How Long Do You Have to Keep Records for HMRC? A Guide for UK Businesses

- Registered Office Address in London, UK: A Guide for Your Business Needs

- Can HMRC Access Your Bank Account? What Every Taxpayer Should Know

- What is a Tax Office Reference Number and How Can I Find It?

- How to Change Your SIC Code on Companies House: A Step-by-Step Guide for UK Businesses

Joy is a content writer at BusinAssist with 6+ years of experience in content marketing and social media strategy. She specialises in company formation and virtual operations, guiding entrepreneurs through global markets with clarity, drawing on her marketing and PR background. Business Assist with BusinAssist – your business success partner.