Last Updated on December 19, 2024 by admin

UK company formation for just £0.99 and get your UK virtual office address for only £0.88 – available for both UK and non-UK residents!

The transfer of shares is pretty common in private limited companies. This process is used when a business wants to bring in new business partners to contribute resources, expertise, or value to the company.

However, shares can be transferred to new investors for the company to raise money either for expansion or improve cash flow, internal restructuring, exit strategy, estate planning, or even as a gift.

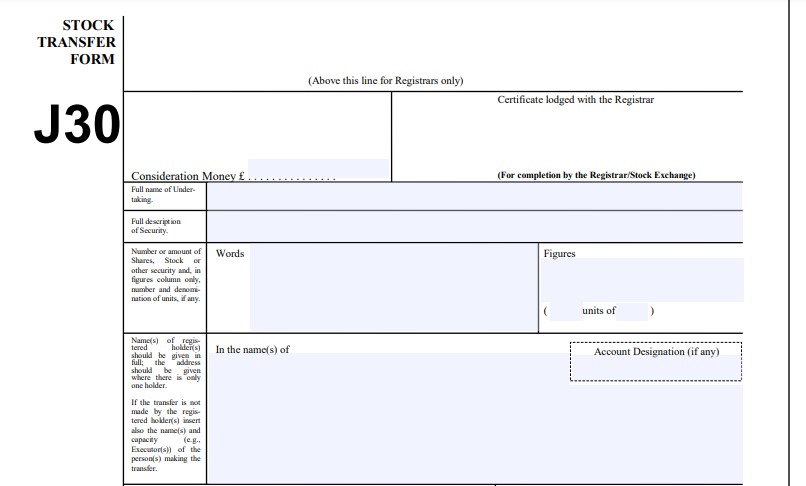

Whether you are transferring shares to a family member or to achieve a specific financial goal, you will need to fill out a Stock Transfer Form, also known as J30.

It doesn’t matter if you are a startup or a conglomerate entity, a stock transfer form j30 will be required for the transfer of shares in the UK.

Business owners, shareholders, and investors should note that every share transfer made for a consideration more than £1000 is liable to pay stamp duty. To avoid penalties, they must pay within 30 days of any transaction.

But what is a stock transfer form J30? In this article, we will explain what form J30 is and give a step-by-step guide on how to fill it out.

What is a stock transfer form J30?

This is a standard document in the UK used for transferring fully paid shares from one entity or person to another. The form lists the parties in the transfer (buyer and seller), as well as the name of the business holding the shares and the sum paid by the buyer.

The amount paid for the shares needs to be documented if it was paid in cash. The amount paid is referred to as consideration. In consideration, additional stocks or debt repayment may also be taken into account.

J30 forms are only valid for shares whose amounts have been fully paid up. If payments are due, shares will only be transferred through a J10 form.

One thing that shareholders and business owners must keep in mind, is that when filling in the Stock Transfer Form is that the form should be filled in capital letters, and in black ink, as this format is acceptable. If errors arise, kindly mark them, make the necessary changes, and initial (or begin again). Avoid using labels on the form or correction fluid.

Download stock transfer form pdf click here: Form-J30

How to complete a Stock Transfer Form (J30)

1. Money consideration

In any share transfer, individuals or entities must agree if the shares will be transferred on a cash basis or with no consideration.

If both parties agree the shares are to be transferred based on cash, the amount that is to be exchanged with the shares should be entered. If there is no consideration involved in the share transfer, enter ‘NIL’.

2. Full name of undertaking

Provide the full name of the undertaking or company whose shares are being transferred. No word or name should be omitted.

3. Full description of security

Specify the class or type of shares such as Ordinary shares valued at £1.00 or Preference shares. Description of class or type of shares can usually be found on the share certificates you possess which cover the ownership of these shares.

4. Number or amount of shares

Indicate the number of shares being transferred, both in words and figures the same way in which a cheque is filled up.

5. Name(s) and address of registered holder(s)

Fill in the current shareholder’s details. Should the shares or stock units listed on the certificate exceed the amount being transferred, a balance certificate will be generated.

6. Signature(s) of transferor(s)

The current shareholder(s) must sign the form. When transferring a joint shareholding, the seller or sellers, as all joint holders must sign and also be aware that in certain cases, another party may sign the stock transfer form.

Additionally, the attorney may sign on behalf of the seller if the Power of Attorney has been registered with the business. Moreover, a group of executives must sign on behalf of the company and declare their respective capacities. This requirement applies to any corporate shareholder registered in England, Wales, or Northern Ireland.

If a company seal is utilised, it will be necessary to include multiple combinations. The date on which the transferor(s) or any representative acting on their behalf signed the stock transfer form must also be recorded.

Officers who are qualified to sign on behalf of the company include:

- Two directors

- One director and the company secretary

- One director and a witness

- Two authorised signatories

7. Name(s) and address of transferee(s)

Provide the details of the person or entity receiving the shares. It is essential to include the names of all joint shareholders in cases of proposed joint shareholdings. The correspondence related to the shares will be sent to the address of the first-named shareholder exclusively.

Frequently, shares are registered under the name of a corporation or organisation rather than an individual. However, transfers are typically documented if the recipient is a private or public limited company established under a specific parliamentary act, royal charter, or in compliance with foreign company laws. This may result in shares being transferred not to the organisation itself, but in certain cases, to the individuals or trustees linked to a charity, trust, association, or club.

If the shares are to be held under a specific account designation or reference, then the “Account designation” box should be completed.

8. Stamp/Name/Address of person lodging the stock transfer form

Should the replacement share certificate need to be issued to a recipient other than the first-named individual on the stock transfer form, please provide their name and address.

9. 1st Certificate

If the consideration for shares transfer is less than £1,000; complete Certificate 1 of the stock transfer paperwork. No stamp duty is required as long as the certificate is fully completed.

You should remove the words “I” or “We” wherever they exist.

If applicable, the certificate should be signed by the person(s) who signs the transfer, their solicitor, or their approved agent. The person signing should mention their signature capacity and the certificate date.

10. 2nd Certificate

In cases where stamp duty is not payable, Certificate 2 of the stock transfer form must be filled out. This includes situations such as

- Receiving shares as a gift,

- Receiving shares from a spouse or civil partner due to marriage or civil partnership,

- Receiving shares as collateral for a loan, and

- Transferring shares held in trust from one trustee to another.

If the consideration for the shares is specified as ‘NIL’ on the front of the stock transfer form, neither certificate is required, the form does not need to be submitted to HMRC, and no stamp duty is due.

What is the stamping process for stock transfer forms?

Fill out the form: First, it is essential to correctly fill out the stock transfer form. This should include the name of the company; specifics of the stock being transferred and all parties involved (the transferor as well as the transferee).

Signatures of both parties: The form must be signed by both the transferee (the purchaser) and the transferor (the seller). Make certain that the electronic signature used here is accepted by law.

Stamp duty calculation: Calculate stamp duty for shares’ trading for which you have paid. Different countries/regions have different stamp duty rates.

Submit to HMRC: Send the completed form to HM Revenue and Customs (HMRC) for stamping purposes through either email or post. HMRC will confirm the details and then add a stamp on it.

Payment of stamp duty: In case stamp duty is applicable, make payment on time. It shows that the transaction involved is legal.

Share register update: As a director of the company, you should be updating your company’s register with information regarding new shareholder(s).

Conclusion

In conclusion, it is important to ensure that all information is accurate and complete to avoid delays and complications in the transfer process. Once the stock transfer form is completed, it should be sent to HMRC to be stamped. However, where Certificate 2 applies, the stock transfer form neither needs to be stamped or sent to HMRC. There will be no stamp duty payable. Additionally, certain categories of transfers may also be eligible for relief, which can either decrease the stamp duty owed or eliminate it.

Transferring shares can frustrate those who are not conversant with the process. BusinAssist can help you with the process and also help with the appointment of new directors, shareholders, or PSCs at very affordable prices.

For more information, contact us at [email protected].

FAQs:

Q: Can a stock transfer form be signed electronically?

Ans: Yes, stock transfer forms can now be legally signed electronically. HM Revenue and Customs (HMRC) accepts electronic signatures for stamping stock transfer forms. The new procedure allows stamp duty processing to be completed online via email, replacing the previous physical stamping system.

Q: Can you transfer shares without a stock transfer form?

Ans: Yes, you can transfer shares without a stock transfer form. When transferring shares, you typically use a stock transfer form to officially document the transfer, however, there are some scenarios where you might not need a physical stock transfer form such as direct transfer between brokers and share transfer within private limited companies.

Q: Do I send stock transfer forms to Companies House?

Ans: No, you don’t need to send a Stock Transfer Form to Companies House. Once you’ve completed the form, you can send it to HMRC to be stamped. However, as a director, you should update your company’s share register with the name and other particulars of the new share owner(s).

Q: What is stamp duty?

Ans: Stamp duty, also known as a stamp tax or documentary stamp tax, is a tax that governments impose on specific transactions and documents. It is typically associated with the transfer of real estate or other assets.

Read Also:

- Top 5 Businesses with Low Failure Rates You Can Start Today

- Right to Work in the UK: How to Obtain a Share Code Online

- How Long Does It Take to Sponsor an Employee in the UK?

- Share Capital: Key Advantages and Disadvantages Every Business Owner Should Know

- What Are the Disadvantages of a Dormant Company?

- Everything You Need to Know About Companies House Default Address

- Companies House Authentication Code: What You Need to Know

- A Step-by-Step Guide to Resign as a Director of a Limited Company

- What is an SA401 Form and How to Submit It to HMRC: A Complete Guide