Last Updated on December 19, 2024 by admin

Taxes are necessary in any economy and every individual and business must fulfill their tax obligations. The self-assessment scheme of the United Kingdom applies to all self-employed people who earn income from different sectors and partners in a partnership structure.

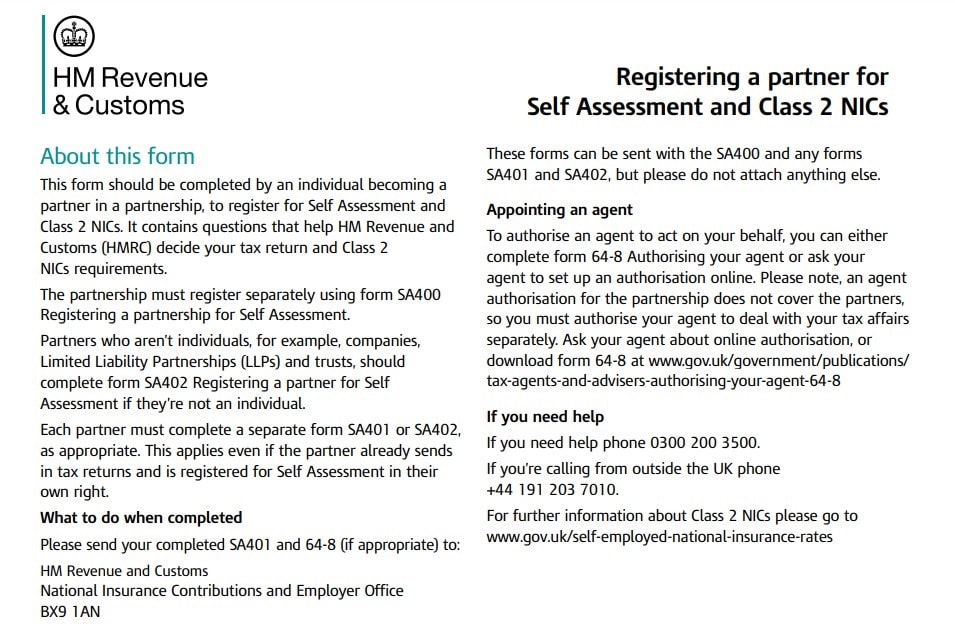

To register with HM Revenue and Customs (HMRC) as a partner, one would need to fill out an SA401 Form. This form is necessary for registering for Self-Assessment and Class 2 National Insurance Contributions (NICs) when you join a partnership. Each partner must complete this form to ensure their earnings are properly reported and they contribute to the National Insurance scheme.

Though you are entering a partnership, it is important to note that you will be liable for your own Self-Assessment tax return. This article will explore how to fill in and submit the SA401 Form to avoid penalty.

What is an SA401 Form?

The SA401 Form serves as an important document that is filled by a self-employed individual and partners when filing his/her Self-Assessment tax return. The reason why such a form is designed is to enable HMRC to absorb all the information regarding a person’s history in employment with all the incomes that have been received during the tax year of both employment as well as self-employment.

Why is the SA401 Form important?

The SA401 Form plays an important role since it enables HMRC to compute the person’s tax responsibilities with precision. Employment history including all sources of income and the amount earned by each such employed or self-employed person helps in ensuring that the right amount of tax has been remitted to HMRC. Also, it serves to avoid tax cheating or underpayment and helps HMRC to detect any irregularities in the tax return lodged. SA401 is crucial for:

Registration: It registers you as a partner in a partnership to make you be recognised by HMRC for tax purposes.

Compliance: This form allows you to ensure you’re compliant with tax obligations by registering for Self-Assessment and Class 2 National Insurance contributions.

Accurate records: HMRC will be able to keep accurate records of your income and National Insurance contributions which is essential in tax calculations.

How to complete the SA401 Form as a partner

Ensure that you have all the information that might be necessary for completing the SA401 Form.

- Download the SA401 Form: The SA401 Form can be downloaded from the HMRC website or it can be filled out online through the HMRC Self-Assessment portal if you have an account. (Form Link: https://assets.publishing.service.gov.uk/media/65d3275de1bdec7737322219/SA401-2023.pdf)

- Personal details: This section requires you to enter your full name, the unique taxpayer reference (UTR) number, and your National Insurance number. The purpose of these details is to enable HMRC to distinguish and associate the submitted form with your tax account.

- Partnership information: Submit partnership details and its UTR (if available) and the date when the person either joined or left the partnership.

- Purpose for that completion of filing: Specify if this form is in connection with a person’s exit from the partnership or a person’s entry into the partnership. Provide a brief explanation of the reason for the change if relevant, e.g., retirement, dissolution of the partnership, or another reason.

- Partner information: If you’re a new partner joining the partnership, include your details, such as your full name, National Insurance number, and residential address. Should you be a partner resigning from the partnership, indicate the actual date of the departure.

- Declaration: After you fill in the necessary information, you will have to sign and date the paper to confirm its accuracy. Be warned that lying bears legal consequences.

Submitting the SA401 Form to HMRC

After filling in and signing the SA401 Form, you are now in a position to send it out to HMRC via:

- Online submission: By far the easiest and most preferred way is to use the HMRC online platform. Once you log into your HMRC account, go to Self-Assessment and you will see the steps on how to file the tax return by including the SA401 Form.

- Postal submission: The SA401 Form can be printed and posted to the address provided on the HMRC page. Please, make sure to ask for proof of postage where possible or use a tracked service so that there is evidence of submission.

- Deadlines: Above all, the SA401 Form is to be sent out within the set time limits. In the case of online submissions, it is normally by 31st January of the year immediately following the end of the tax year. In the case of postal submissions, HMRC should receive it by 31st October of the year immediately following the end of the tax year.

Once the SA401 Form has been processed, partners can proceed with their individual Self-Assessment tax returns. This process will require them to provide information regarding the partnership, including the partnership’s Unique Taxpayer Reference (UTR) number and the relevant accounting dates. Additionally, partners must report their respective share of the partnership’s profits or losses. In cases where a partner is engaged in multiple partnerships, it is necessary to fill out a distinct section for each partnership.

By following these steps, you will be able to fill out the SA401 Form and submit it to HMRC ensuring that you will meet your Self-Assessment tax obligations. As has been noted before, the SA401 Form is an important document in filing tax returns by self-employed persons. When you provide such details as work history, income earned, where the income is from, and how much the income is, you assist HMRC in carrying out appropriate taxation and helping in combating tax avoidance. To remain compliant with the laws and regulations provided by HMRC, it is advisable that one fills out the SA401 Form up and submits it before the due date.

Want to upgrade from a sole proprietor to a limited company, BusinAssist will help you with the incorporation process. Our hassle-free process will make your business transition seamless. We offer UK virtual office packages that have a business address that will help you keep your home address private. The package comes with additional benefits that will help in your business operation as you focus on growing your company.

We also offer VAT and EORI number registration, help in ongoing compliance, logo creation, domain name, website builder software, and opening of bank accounts.

For more information, contact us at [email protected].

FAQs

Q: Can I do a digital signature on SA401?

Ans: Yes, you can use a digital signature on the SA401 Form as long as you provide the signature yourself for it to be valid. HMRC accepts digital signatures for certain forms including SA401 Form.

Q: Can SA401 be done online?

Ans: Yes, the SA401 Form can be completed online. To complete the SA401 Form online, you will need to create an account with HMRC and log in using your Unique Taxpayer Reference (UTR), partnership UTR Number, and partnership name, address, and other details. Once you log in, you can register for the form in a few minutes. Once you hit the submit button after filling in the form, HMRC will process your registration within 10 working days.

Q: How to register a partner for Self-Assessment SA401?

Ans: To register a partner for Self-Assessment using the SA401, you can do it online or appoint an agent to do it on your behalf. If you choose to complete the process by yourself online, you will have to:

- Download the form

- Fill in your personal details such as your name, address, National Insurance number, residence, and UTR if you had previously registered for Self-Assessment.

- Details about the partnership you have joined.

- Your declaration

- Then submit the form.

Q: Where to get an SA401 Form?

Ans: You can get the SA401 Form online by visiting the HMRC website. If you want to complete it online, create an account with HMRC, fill in the form, and submit it. If you want to send it by post, download the form on the HMRC website, fill out the form, print it then post it to HMRC.

Q: Where to send the SA401 Form?

Ans: Once the SA401 is filled out, you can send it to HMRC either online or by post.

Read Also:

- How to Change Your SIC Code on Companies House: A Step-by-Step Guide for UK Businesses

- Understanding the Timeline: How Long Does It Take to Get a Tax Refund After Self-Assessment?

- Lost Your Government Gateway User ID and Password? Here’s How to Find Them

- How to Fill Out a Stock Transfer Form J30: A Step-by-Step Guide

- Understanding the Importance of a Tax Identification Number in the UK

- Everything You Need to Know About Companies House Default Address

- What Are the Disadvantages of a Dormant Company?

- Share Capital: Key Advantages and Disadvantages Every Business Owner Should Know