Last Updated on December 20, 2024 by admin

UK company formation for just £0.99 and get your UK virtual office address for only £0.88 – available for both UK and non-UK residents!

A government Gateway user ID is vital for businesses in the UK to use to access HM Revenue and Customs (HMRC) services. Losing your user ID and password can be frustrating, however, there are ways to recover them.

This article will guide you on how do I find my Government Gateway user ID and password, as well as how to recover them, not forgetting to highlight government services you can access in your Government Gateway account.

What is the Government Gateway?

Government Gateway is a system used to register and access UK government services online such as those of HM Revenue and Customs (HMRC).

A Government Gateway account allows business owners to handle their taxes and personal information with HMRC online. The Government Gateway user ID is a 12-digit number that serves as a method of HMRC to verify your identity when you want to use various online services.

With a user ID, business owners can file tax returns, update their tax information, Self-Assessment, and VAT registration.

How to create a Government Gateway user ID?

To create a Government Gateway account, you will need to provide the following details:

- Your full name.

- An email address for the account, as all correspondence will be sent to this address; ensure you have complete access to it.

- A secure password, which should be at least 10 characters long and can include a combination of letters, numbers, and symbols.

- A recovery word, which will assist you in case you forget your password.

Once you have this information, you can set up your Government Gateway account by following the instructions provided on the HMRC website.

How do I find my Government Gateway user ID and password?

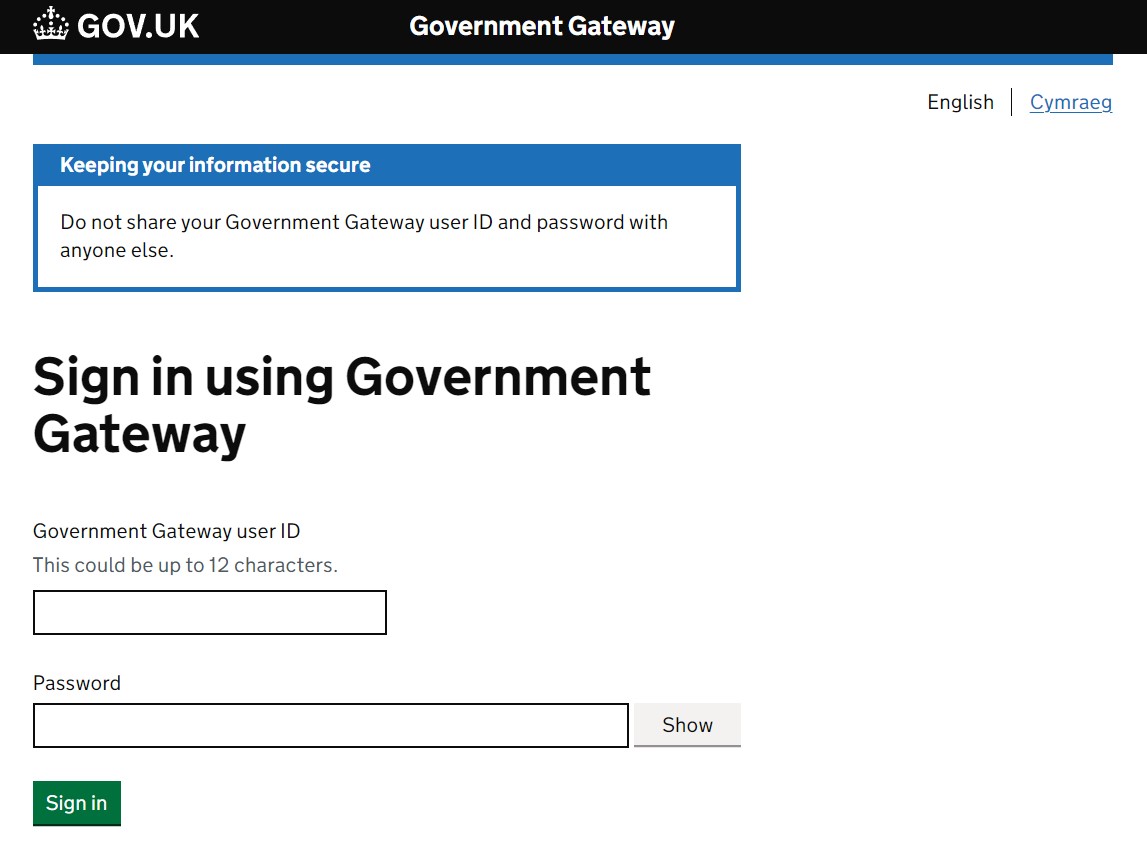

If you remember your user ID but have misplaced your password, it is possible to reset the password for your Government Gateway account. To do so, you must provide your Government Gateway user ID along with the email address that was used when the account was created. If you have a multifactor authentication set up, a code will be emailed to you that you need to enter. Enter your Government Gateway user ID then enter the code sent to the device you set up multi-factor authentication on and create a new password.

In the event that you do not have a multi-factor authentication for your account, a code will be sent to your email, which you must enter on the screen. Next, provide your Government Gateway user ID. If you have established a recovery word, you will be required to enter the specified letters of that word. Finally, proceed to create a new password.

However, if you have lost both the user ID and password, you can recover them by following these steps on how do I find my Government Gateway user ID and password:

Search in your email address:

When registering your Government Gateway account, your user ID should have been emailed to you. You can verify your email account for a message titled ‘Your Government Gateway ID.’ In the event that you have deleted this email or cannot access your email account, it is advisable to contact HMRC for assistance, as this may suggest that you need to complete the registration process again.

If you have successfully retrieved your ID, you can navigate to www.gov.uk/hmrconline and enter your ID. Assuming that you have retained your password on your computer for a smooth login experience. If this is not the case, please contact HMRC for further assistance.

Visit the HMRC service registration page:

You can visit the HMRC service registration page and click the “Sign In” button. Navigate to the “problems signing in” section and click on “I have forgotten my Government Gateway user ID and password”. Enter the email address associated with your account and click “Continue”.

Call HMRC helpline:

If you can’t find either of the two in your email or at the HMRC service registration, you can contact HMRC helpline to help you. The number you need to reach will be determined by the service associated with the Government Gateway account you are trying to access.

What services can I access with a Government Gateway account?

Personal or business tax account: Access details related to your income tax estimate, tax code, and claim tax refunds if applicable.

Self-Assessment: Submit your tax return for rental or investment income.

Corporation Tax: Manage tax affairs for limited companies.

PAYE for Employers: Handle payroll and employee tax deductions.

VAT: Register for VAT voluntarily or if your turnover exceeds £90,000.

Charities online: This is a service provided by the UK government that allows eligible charities to claim tax refund on donations.

Construction industry scheme: Contractors and subcontractors can register for CIS.

Customs declaration service: Businesses involved in import and export can register and make customs declarations. They can also obtain postponed import VAT statements or import VAT certificates (important for completing your VAT Return).

Gift Aid: Charities and community amateur sports clubs (CASCs) can claim Gift Aid.

Money laundering supervision: serves as a supervisory body for money laundering regulations. If you’re involved in certain business activities, you may need to register for money laundering supervision with HMRC.

Pension scheme: You can register and manage your pension scheme.

What is the importance of a Government Gateway account?

- Access government services: You can use a single set of credentials to access a variety of online platforms and government services when you have a Government Gateway account.

- Provides efficiency: You can handle tax matters, file forms, and access services for taxes, customs, pensions, and other things with this account. Tasks can be completed online, which eliminates paperwork and manual labour.

- Protects your personal data: Two-factor authentication (2FA) and credentials are used by the account to guarantee secure authentication. Unauthorised access will not be granted to your confidential data.

- Reminders and notifications: The account sends out reminders and notifications regarding deadlines, updates, and significant occasions. Setting reminders will help you remember what needs to be done.

Conclusion:

In conclusion, it is important to keep your user ID and password safe, however, if you happen to lose any of them you can access them through your email, HMRC service registration page, or contact HMRC helpline to help you recover them.

BusinAssist can help you create a Government Gateway account seamlessly when forming a UK-limited company. When you place an order for UK company formation, you may opt for an add-on service that will generate your Government Gateway user ID. You will receive an email at your registered address containing the Government Gateway user ID, which you will need along with your password for future logins.

Once your Government Gateway account has been established and you have access to your user ID, you will need to log in again to set up additional security measures using your phone number.

Each time you access HMRC online services, you will be required to verify your identity through a two-step authentication process.

For more information, contact us at [email protected].

Read Also:

- How Much Does It Cost to Set Up a Limited Company UK?

- Companies House Authentication Code: What You Need to Know

- What is an SA401 Form and How to Submit It to HMRC: A Complete Guide

- Understanding HMRC Errors and Mistakes Guidance: Your Rights and Responsibilities

- What Are the Disadvantages of a Dormant Company?

- Everything You Need to Know About Companies House Default Address

- The Hidden Costs of Being VAT Registered: Is It Killing Your Business?

- Should I Trademark My Business Name UK? What You Need to Know

- Share Capital: Key Advantages and Disadvantages Every Business Owner Should Know